Tem gente que está tremendo: afinal, são US$ 350 bilhões de dívida, num mercado imobiliário que representa 28% do PIB chinês. Pode dar calafrios em muita gente. Os ocidentais colocaram no último ano mais de 500 bilhões de dólares na China. Tudo vai fundir?

Paulo Roberto de Almeida

Adam Tooze's Top Links: Is Evergrande "China's Lehman moment"? (#21)

Stuff to read and listen to ahead of a nail-biting week.

Is the long-awaited “China crisis” upon us? If Evergrande implodes, will it be China’s Lehman moment?

Certainly, it will be at the top of the financial news in the coming week. The meltdown now seems irreversible. It will be controversial. Assessments of the crisis will bring into play wider views of China’s outlook.

To help guide you through the news, this special edition of Chartbook Top Links pulls together some useful links and reading:

There is a mass of good stuff out there. The smart money is definitely not betting on a Lehman-style implosion with uncontrolled systemic contagion. But it is also clear that this crisis poses a huge challenge for Beijing’s crisis-management. It is another test of “Keynesianism with Chinese characteristics”.

The basics:

China’s financial markets are closed on Monday and Tuesday 20-21 September. But as Bloomberg reports, Evergrande’s inability to service its debts will likely become apparent on Monday.

It will be scary. Rumors like this are circulating:

There have been dramatic scenes in China.

Thousands of staff have been affected. For a good human interest story, see this report by the New York Times.

Evergrande has $305 billion in debts outstanding. Its footprint in China’s economy and society is large. For good basic backgrounder, check out this report by The Guardian.

For some metrics check out this CNBC report:

Evergrande owns more than 1,300 real estate projects in over 280 cities in China.

Its property services management arm is involved in nearly 2,800 projects across more than 310 cities in China.

The company has seven units dabbling in a wide range of industries, including electric vehicles, health-care services, consumer products, video and television production units and even a theme park.

The firm says it has 200,000 employees, but indirectly creates more than 3.8 million jobs every year, according to its website.

Evergrande’s shares and bonds are included in indexes across Asia.

In an August report, S&P estimated that over the next 12 months, Evergrande will have over 240 billion yuan ($37.16 billion) of bills and trade payables from contractors to settle — around 100 billion yuan of that amount is due this year.

A paint supplier to Evergrande, Shanghai-listed Skshu Paint, said in a filing that the real estate firm repaid part of its debt in properties – and uncompleted ones at that.

Here is a finance twitter summary (NB expletives included):

According to SCMP, Evergrande’s major China investors are bailing out.

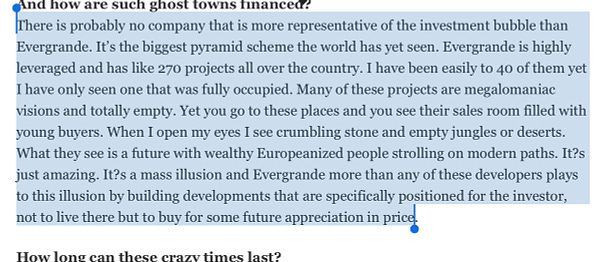

“Crumbling stone and empty jungles”

One thing is clear. No one in the markets is really surprised by what is happening. This crisis has been a while in the making. Back in 2017 there were this kind of warning ….

zerohedge @zerohedge

"Evergrande is the biggest pyramid scheme the world has yet seen" - J Capital's Anne Stevenson-Yang, 2017 https://t.co/Zt8hRDZNZQReal Estate Kraken

If memory serves, I first became aware of Evergrande in 2018 with this FT Alphaville’s report by Jamie Powell. I remember it blew my mind. It was one of my talking points in the months following the release of Crashed.

At the time, the IMF was very worried about systemic risk arising from China’s overinflated real estate sector.

Contagion?

For the rest of the economy and the world at large it is not so much Evergrade’s collapse per se, but the resulting contagion that matters.

On finance twitter, two very knowledgeable observes have delivered important threads. The fabulously-named Girolamo Pandolfi da Casio ditto Carlo Dossi Erba got their first:

You can get it unrolled here

The punchline is sobering: “If funding stress signs don’t emerge, don’t conclude that there is no contagion. Contagion is playing out already if you know where to look.”

But how bad is it going to be? Jens Nordvig went looking and in his first thread he arrived at rather less dramatic conclusions.

There was contagion last week, but it was confined to immediately “adjacent” real estate bonds.

Over the weekend Jens Nordvig doubled down with this thread on why Evergrande is unlikely to be China’s Lehman.

Jens Nordvig @jnordvig

There is a huge amount of focus on China contagion/Evergrande at the moment. Hence, it is a time to be precise. I will not do a comprehensive thread (yet). But just provide some specific color on the High Yield credit moves, which themselves are generating a lot of attention.Very well-informed China Beige Book concurred: “critical to recognize that all of this hinges on how broadly "contagion" is defined. This is not Lehman. There is no durable counterparty risk when the state owns or controls all of the counterparties.”

But as they pointed out in another tweet: “"Signs of stress are appearing in China banks’ loan books, as more of their corp loans to developers go sour...“We haven’t seen such a high level of bad #property loans in over a decade” Balance sheets only provide visibility into the tip of the NPL iceberg

Their source was this WSJ report.

Controlled demolition?

The collapse of Evergrande has many of the attributes of a classic saga of corporate “rise and fall”. But it is also the effect of direct intervention by Beijing. As this report in the WSJ makes clear, Beijing is attempting to deflate the giant real estate bubble.

The crucial question is, can Beijing manage this controlled demolition?

A Bloomberg team paints a picture of how it could all go wrong.

As Kent Willard speculates this could be a futher step towards Beijing’s assertion of control: “Xi will use Evergrande to rationalize a much stronger control over large corporations, provincial governments, and asset prices. Evergrande isn't the catalyst as much as the excuse. It won't be a financial crisis, but a controlled burn of the world's 2nd largest economy.”

Future of the China model.

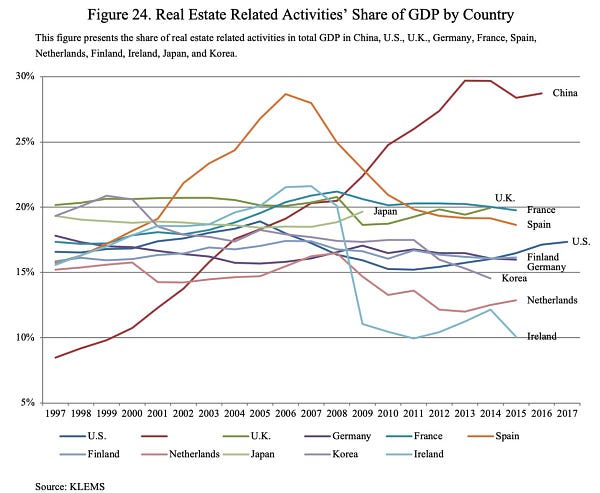

The real worry going forward may be less the risk of an acute financial crisis, than the impact on the real estate sector as a whole, which according to some calculations accounts for as much as 28 percent of Chinese economic activity.

Implications:

What are the implications for the rest of the world?

Andreas Steno Larson of Nordea in his influential weekly report argues that Evergrande is not another Lehman, but it does pose a significant risk for export-dependent German economy.

If you are in New Zealand or Australia, Evergrande feels a lot closer than it does in Europe or the US:

Politics

The crisis reverberates at a moment when relations between China and the West are extremely tense. Political and geopolitical tensions have been escalating. But, at the same time, big money has been flowing from West to East. In the 15 months through June 2021, global investors on the rebound from COVID have bought $527 billion of Chinese stocks and bonds.

Money one way, geopolitics the other - so striking has this dislocation become that it has attracted interesting commentary. See, for instance, this piece by the FT.

The world of finance itself is divided. BlackRock and other big US players have continued to argued for engagement in China. By contrast, George Soros, the anti-Communist warhorse, has come out with all guns blazing. First in the pages of the FT and then in the WSJ, Soros has blasted what he regards as a fundamental miscalculation of Western investors.

The WSJ headline was particularly garish.

So direct was his attack that in the days that followed, BlackRock was forced to mount this rather lukewarm defense.

Will Evergrande tip the balance? Will Western investors panic? Will Evergrande trigger a break in another strand in China’s relations with the West?

As Bill Bishop at Sinocism pointed out, lines of communication between Beijing and Wall Street are running hot right now. Expect this argument to heat up!

In reading commentary on the events it is useful to remind oneself that there are a lot of players with “skin in the game”. Commentary on the events themselves is highly politicized.

Stanley Chao @stanleychao6

It's also amazing how everyone on Twitter, over the past 2 years, has suddenly become an expert on #China. https://t.co/3J4HZgTcWR