Opinion 12:34, 27-Oct-2020

Editor's note: All eyes are on the U.S. as the presidential election draws near. Who has actually benefited from Donald Trump's trade polices? Did the U.S. become safer during his term in office? Who is winning on the Twitter battlefield for the White House? Data Speaks dedicates three episodes on these matters. The first episode is on Trump's trade policies.

As the end of Donald Trump's first term as U.S. president nears, which countries have benefited most from his trade policies?

U.S. customs import value from Asia obviously declined after the China-U.S. trade war started, whereas there were sustained rises from Europe and North America, so a winners list in this region is often assumed.

But the pandemic reshaped the world in 2020. Data speaks, and in this case it offers a unique viewpoint.

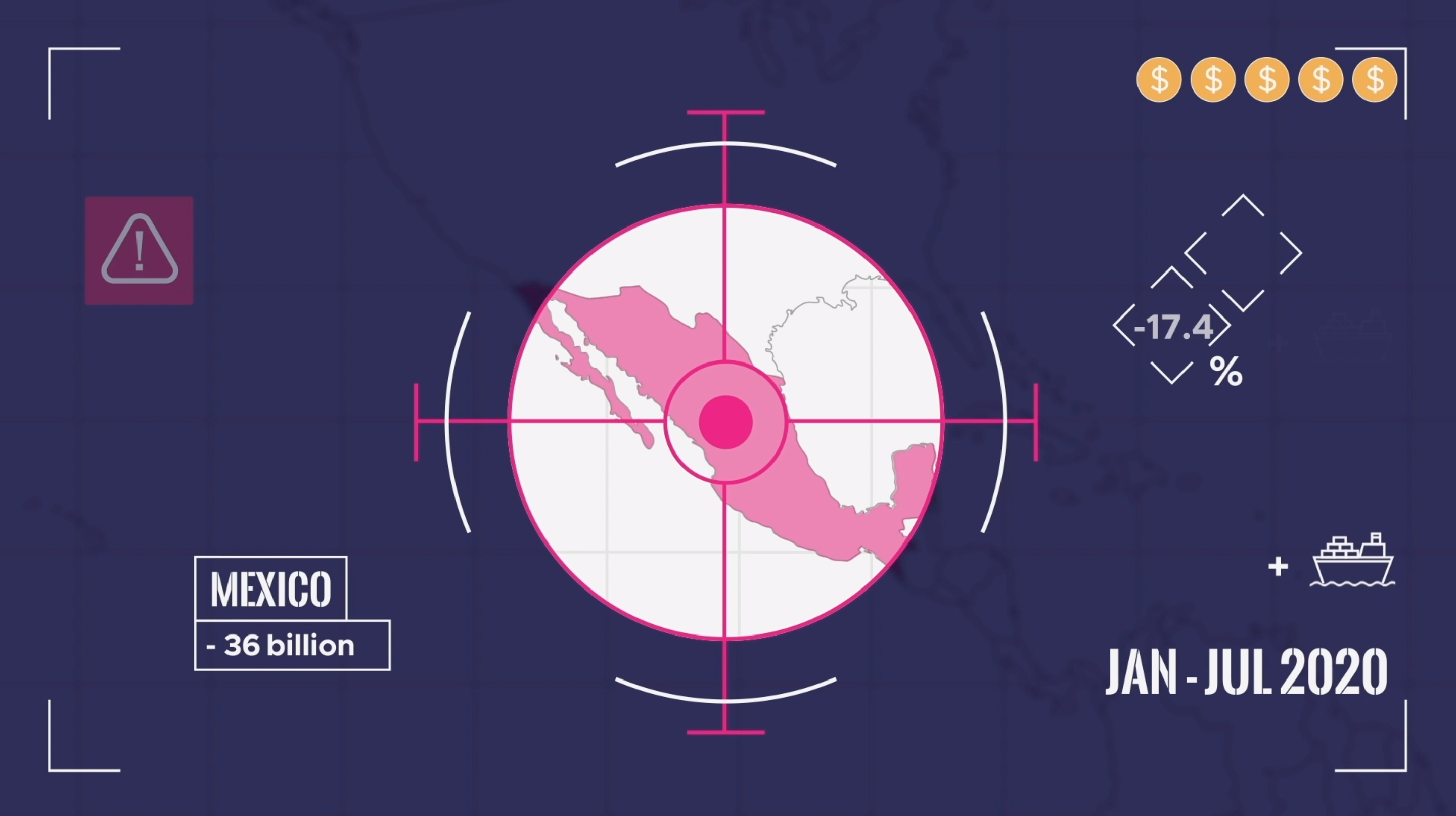

Mexico has seen U.S. purchases ramping up in recent years. It exported goods to its neighbor valued at an additional $64 billion from 2016 to 2019. However, amid the pandemic, orders of Mexican products fell by $36 billion from January to July 2020.

The same situation is confronting other major exporters, including Germany, Italy and India.

The reason may be beyond the coronavirus. The Chinese mainland's exports to the U.S. decreased by $38 billion in the first seven months of this year — in the last four years, the number was nearly $11 billion.

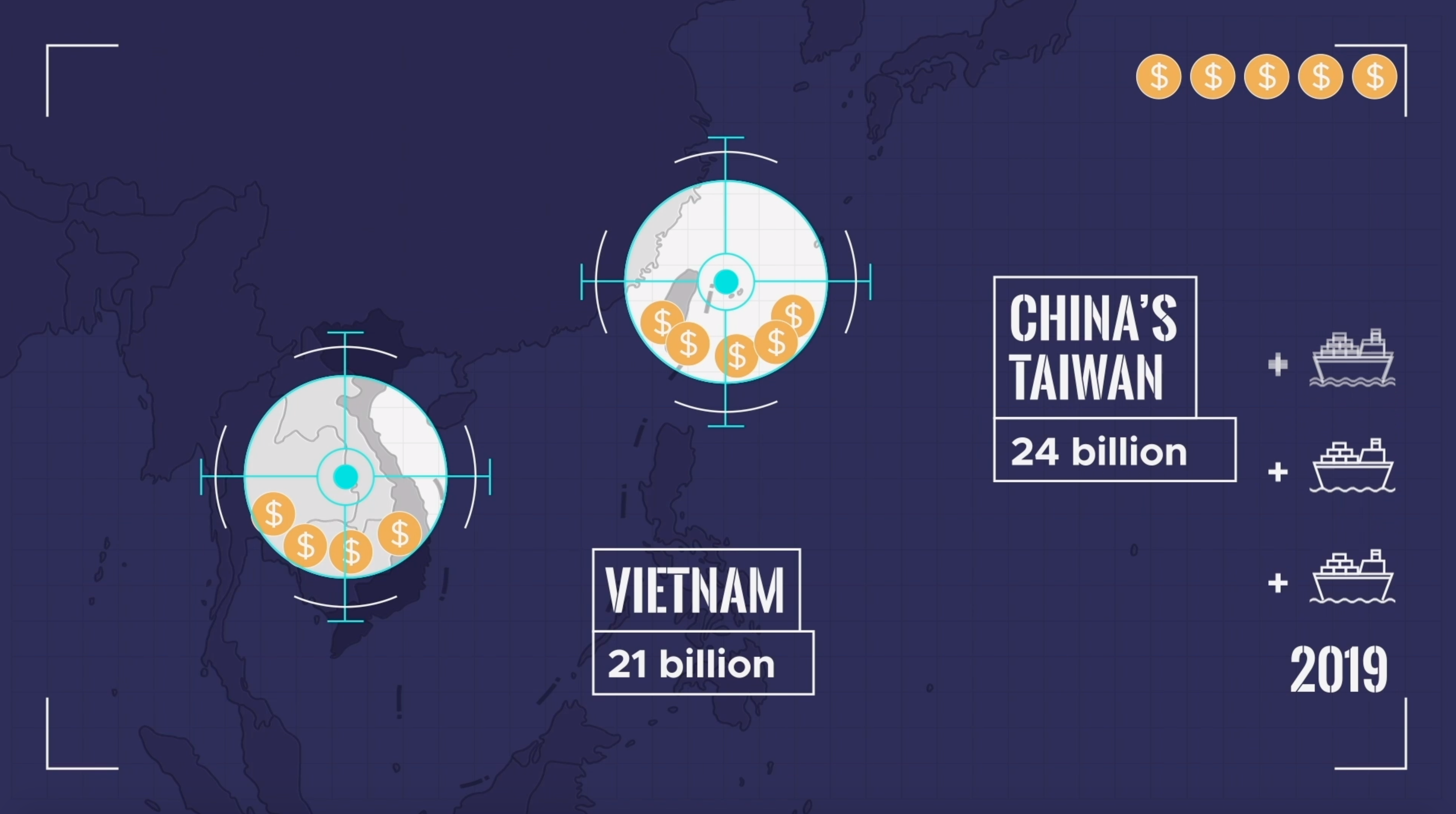

So who are the main beneficiaries? Vietnam, Ireland and China's Taiwan region are high on the list of winners. For them, orders from America have continued after the pandemic. Besides political considerations, to economies of limited scales, the benefits from such orders are almost irresistible, but can be costly with hidden risks. Rising tensions are possible in east and southeast Asia, especially in the computer and electronic products sector.

To China, the U.S. sharply cut $40 billion in orders from 191 billion in 2019, while Vietnam and China's Taiwan region completed the most exports to the U.S. at $21 billion and $24 billion respectively.

What else are Americans seeking in Vietnam and Taiwan region? Natural resources and related products.

The U.S. import value in petroleum and coal products from Taiwan region grew by 147.2 percent from 2016 to 2019, along with an increase of 80.3 percent for forestry products. In the same period, that of wood products and paper from Vietnam also rose by 231.6 percent and 168.2 percent respectively.

Compared with an average month in 2015, Vietnam's monthly Index of Industrial Production by the printing industry was up to 267.9 in October 2019.

Huge demand from the U.S. for natural resources is also evident with other trading partners. The top three sectors in terms of imports value to the U.S. from Mexico were minerals and ores, wood products and oil and gas.

Is any economy making more sales to the U.S. market in a sustainable way? Yes, it's Ireland.

Between 2016 and 2019, Ireland's chemicals industry absorbed an additional $12.3 billion. Beverages and tobacco products made in Ireland are also popular with Americans. Of course, the consequences of Trump's trade policies are more complicated than simply checking changes of U.S. imports values, especially when considering the political, cultural and military fields.

And China is rerouting supply chains as well: its trade diversions can benefit other countries. In a dramatically changing world, no country can be sure of being the final winners or the victims in the long run.

(If you want to contribute and have specific expertise, please contact us at opinions@cgtn.com.)

Nenhum comentário:

Postar um comentário