Uma das mais importantes notas do Chartbook que li nos últimos tempos.

The end of globalization as we know it?

Larry Fink, CEO of BlackRock’s annual letter to shareholders stirred a flurry of debate last week about Putin’s invasion of Ukraine, the future of globalization, supply-chains, inflation and its implications for investors.

Even in our moment of general pessimism about the world’s economic prospects, the boss of the largest asset manager in the world declaring that we are witnessing the end of globalization, is worthy of a headline.

In truth, like most people, the FT’s summary of Fink’s letter was all I read until I agreed with my friends Robert Armstrong and Ethan Wu to make the future of globalization the topic of our second exchange of newsletters between Chartbook and Unhedged, the top financial markets newsletter at the FT.

Partnering with Unhedged is a real privilege.

Unhedged is the FT’s indispensable newsletter on the stories and ideas moving the markets. There is no better place to read the mind of the market.

Number 2 in our series offers readers of Chartbook a flavor of Robert and Ethan’s view of the headwinds facing globalization and the inflationary pressures ahead. See below:

To read my take on the same topic, readers of Chartbook can use this exclusive link to access Unhedged and all its excellent content.

It is, as I said last week, quite a thrill to be offering readers of Chartbook access to such premium content.

****

FROM HERE YOU ENTER THE WONDERFUL WORLD OF UNHEDGED

Last August, in the context of the “is inflation transitory” debate, Rob wrotethat, “determining whether we are entering a new regime or returning to the old one is above my pay grade (it may be above everyone’s).” That remains Unhedged’s attitude. In September 1981, it was recently pointed out to us, few people would have recognized that we were at the high water mark for interest rates or appreciated how transformational figures such as Reagan, Thatcher, and Volcker would turn out to be. Grand theses about the direction of history sell books but age badly. Understanding the present is hard enough.

That said, there are a number of big changes taking place simultaneously, and the pace of many of those changes appears to have been accelerated by the pandemic and Russia’s war in Ukraine. To an extent, this is obvious. Brexit, the election of Trump, the collapse of the TPP, rising tensions between China and the US, the 40-year high in inflation -- all this is in front of our noses. Yet it is not obvious how much any of this will actually affect the way trade is done, markets operate, or capital is priced.

Unhedged’s guess is that there will be meaningful impacts. The world of the past several decades has gained from low rates, low inflation and growing global ties under liberal-democratic hegemony. We think that world is on its way out, and put the key changes into four categories: geopolitical shifts, the rise of populism, the energy transition, and demographics.

In geopolitics, borders are hardening. The US and China are pulling apart in fits and starts, especially where technology is concerned -- with US restrictions on Huawei, and threats to revoke US listings of other Chinese tech firms matching China’s long standing limits on US tech giants operations in China.

The US business lobby that once pushed for cordial relations with China has almost entirely switched its stance toward confrontation, notes former IMF China head Eswar Prasad. First drawn in by the country’s vast and increasingly rich population, firms began to realise that access to Chinese markets came with strings attached. As accusations of intellectual property theft and forced technology transfer flew, corporate America soured on China.

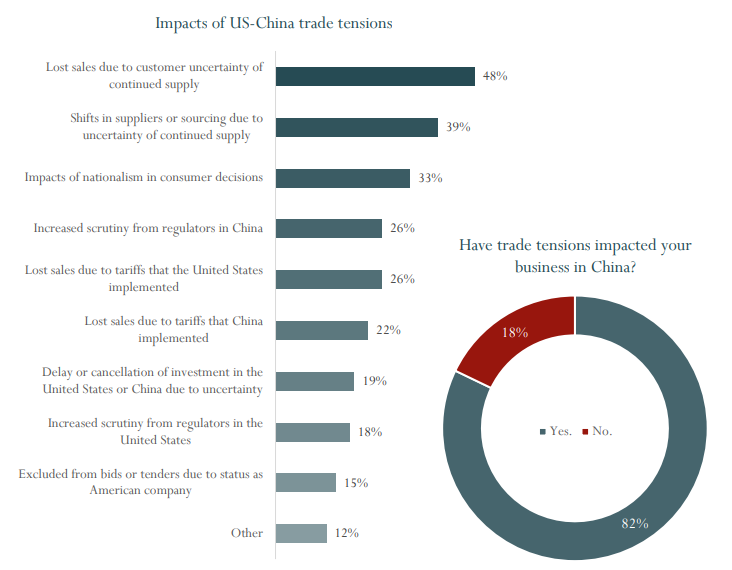

US foreign direct investment in China peaked in 2008 at $21bn and has since fallen to $9bn as of 2020. Chinese FDI flows to the US have also stalled. American businesses in China report lost sales, consumer boycotts and suffocating uncertainty — some of which is Washington’s doing. From the US-China Business Council’s 2021 member survey:

The Ukraine war and the sanctions regime that have followed will bring this balkanization into the financial realm, as the sanctioning of Russia’s central bank puts other regimes, including China’s, on notice. Martin Wolf recently wrote in the FT about what might result from the “weaponisation” of reserve currencies:

The overwhelming dominance of the US and its allies in global finance, a product of their aggregate economic size and open financial markets, gives their currencies a dominant position. Today, there is no credible alternative for most global monetary functions … In the long run, however, China might be able to create a walled garden for use of its currency by those closest to it … What might emerge are two monetary systems — a western and a Chinese one — operating in different ways and overlapping uncomfortably.

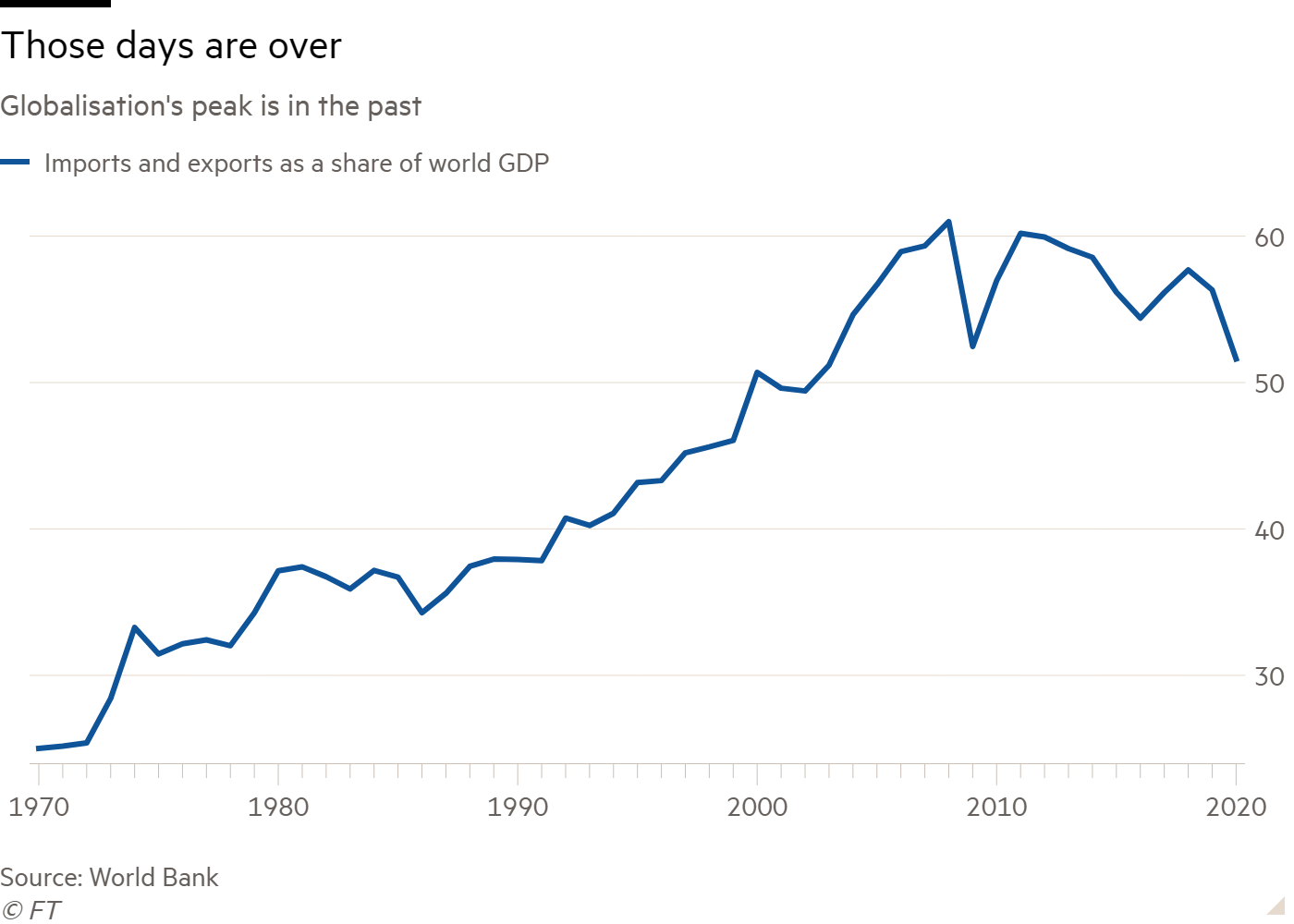

Even before the war, trade as a portion of global GDP had been flatlining. Recent flare-ups will reinforce a pattern that was already in place:

A more balkanized word, potentially split along a democratic/authoritarian axis, will not enjoy the deflationary benefits of a more unified one. Michael Hartnett of Bank of America -- perhaps Wall Street’s leading adherent to regime change view -- thinks that it also heralds a shift in stock market leadership:

With the balkanization of the global financial system and internet, you don’t get the benefits of scale [tech thrives on]. Then liquidity dries up [as policy tightens and rates rise]. What kills a bull market in tech is saturation and regulation … for national security reasons regulation tightens, at the same time as rates go up, so valuations should go down, and the stuff that is most egregiously overvalued is damaged the most. That happened already for unprofitable tech, and we have not seen it yet for profitable tech … tech is going to be the worst performing sector in the 2020s.

What will work? It comes back to selling hubris and buying humiliation, and we know where the humiliation is … banks, Europe, to an extent Japan

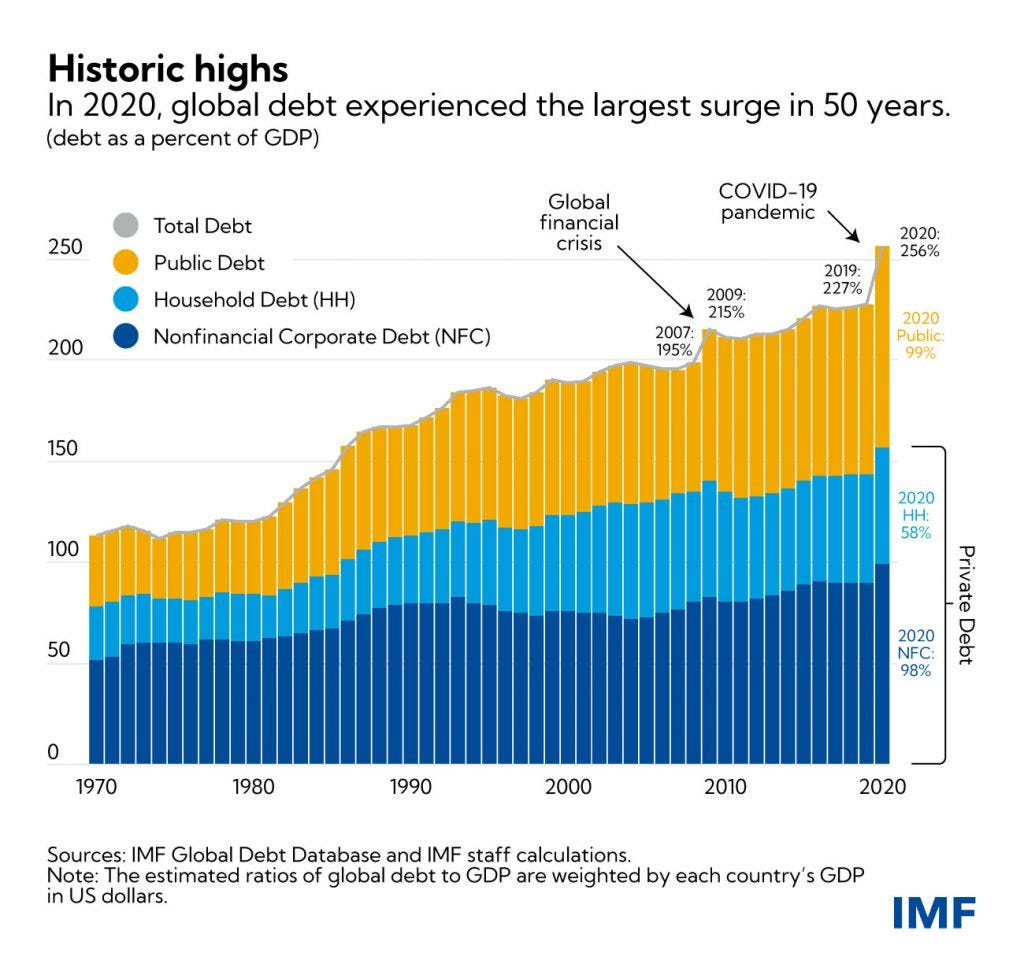

The post-pandemic manifestation of populism in politics is the addition of fiscal profligacy to the easy monetary policies that have characterised the decade since the financial crisis. Debt has spiked, and the policial temptation to deploy fiscal alongside monetary stimulus, after combination proved its power in the pandemic, will not prove easy to resist:

Historic public debt loads are not in themselves catastrophic. But combined with rising interest rates, debt-servicing burdens around the world will grow. Some governments will face a nasty choice — fiscal austerity or fully monetising the debt. The former will probably hurt growth; the latter could stoke inflation. Both are likely to be unpopular, and could further embolden populists playing to real anxieties. A financial crisis can’t be ruled out. IMF research finds that a swift uptick in household debt — precisely what Covid has brought — raises the probability of a future banking crisis by nearly 30 per cent (though the base risk is low).

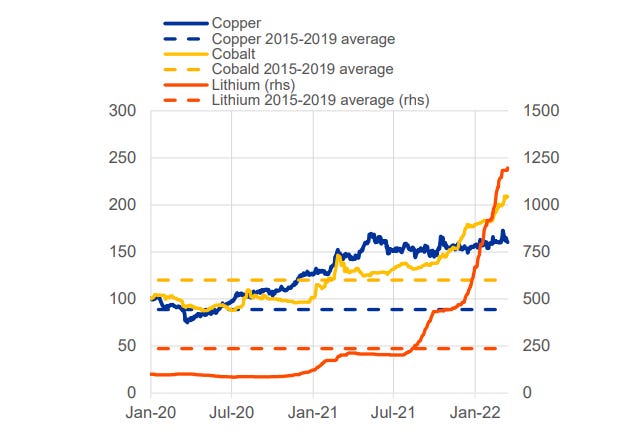

The energy transition is proving to be inflationary in two respects: investment in it is driving the price of hard commodities, while oil prices rise due to weak supply, driven by environmental policies, investor demands for high returns, and possibly the simple exhaustion of easily accessible reserves in the ground.

Isobel Schnabel of the ECB provided a good summary of the first inflationary effect in a speech about policy responses to greenflation:

Most green technologies require significant amounts of metals and minerals, such as copper, lithium and cobalt, especially during the transition period. Electric vehicles, for example, use over six times more minerals than their conventional counterparts. An offshore wind plant requires over seven times the amount of copper compared with a gas-fired plant. No matter which path to decarbonisation we will ultimately follow, green technologies are set to account for the lion’s share of the growth in demand for most metals and minerals in the foreseeable future. Yet, as demand rises, supply is constrained in the short and medium term. It typically takes five to 10 years to develop new mines… Export restrictions on Russian commodities may add to pressure on prices over the near term… the faster and more urgent the shift to a greener economy becomes, the more expensive it may get in the short run…

the significant need for private and public investment associated with the green transition itself is a reason to believe that real interest rates may rise from their subdued pre-pandemic levels.

She provides this eye-popping chart of percent changes of key “green” metal prices:

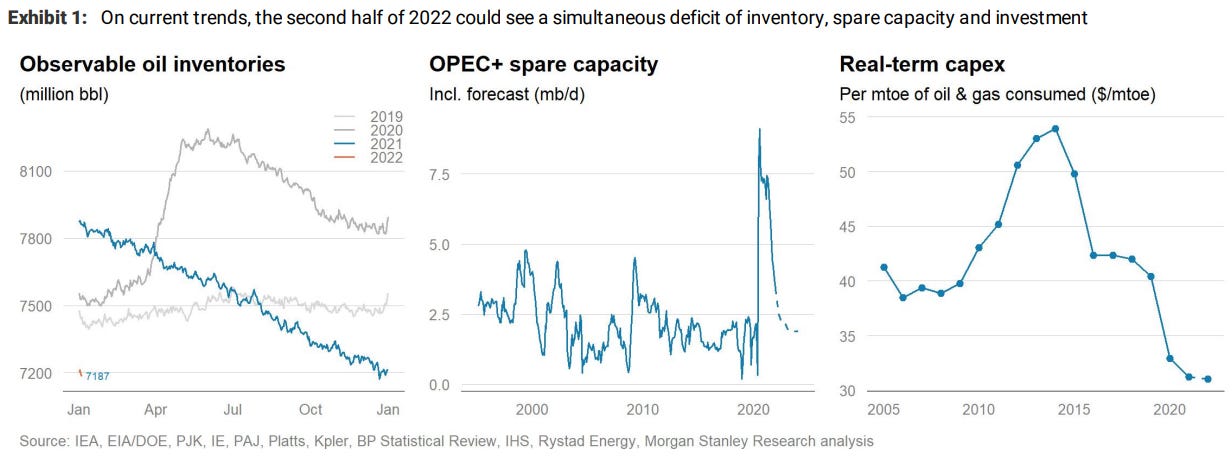

The likelihood of lasting upward pressure on oil prices is neatly described in this graph from Morgan Stanley, showing historically low inventories above ground, diminishing spare capacity among Opec countries, and low investment:

Many of these emerging trends point towards either higher interest rates or higher inflation, or both. Demographic changes, specifically the ageing of the global population, could well exacerbate those effects. This argument’s most well-known proponents are the economists Charles Goodhart and Manoj Pradhan.

Unhedged has written about their views several times before. To sum up, for several decades moving production to low-wage countries has kept inflation low, but as the populations of those countries (particularly China) crest and begin to fall, wages there will rise at the same time as working age populations in rich countries fall. The increasing number of ageing dependents over workers is inflationary, and at the same time, as those dependents spend their savings, the global balance of savings and investment shifts back towards investment, driving the neutral interest rate up. A declining savings glut could also reduce inequality.

The Goodhart/Pradhan view is controversial, but there is no doubting the scale of the demographic shift that is taking place, with China at the forefront of it. It will matter, even if we are not sure how.

However wise or dumb our view of the future is, markets don’t share it, as Larry Summers pointed out to us. Current prices strongly imply the current spike in inflation and rates will subside before very long, and the old world of “secular stagnation” will re-assert itself. This is most easily visible in the Fed funds futures curve, which suggests rate increases will stop below 3 per cent some time next year, and that policy will weaken thereafter.

“The yield curve is telling us we will end this expansion with negative real rates … the market is telling us there still is secular stagnation on steroids” Summers says. “The demographic arguments, the green investment arguments, the new fiscal era arguments are all of the form ‘we will leave the world of secular stagnation and move to a world of permanent excess demand.’ The markets think they are wrong -- if you look at multiples of real estate and PE multiples on stocks, the market does not foresee higher real rates.”

To repeat: Unhedged is acutely aware of the limits of big-trend prognostication. What we are arguing is that geopolitical tension, populist fiscal policy, the energy transition, and an ageing world are all important, all coming to a head simultaneously, and are all discontinuous with the low rate, low inflation, high integration, hegemonically liberal-democratic world we have enjoyed since 1980s. That era does seem to be dying, even if we can’t be sure yet what era is being born.

Nenhum comentário:

Postar um comentário