Why Growth Will Fall

The Rise and Fall of American Growth: The US Standard of Living Since the Civil War

by Robert J. Gordon

Princeton University Press, 762 pp., $39.95

Gustave Caillebotte: The Floor Planers, 1875

Robert Gordon has written a magnificent book on the economic history of the United States over the last one and a half centuries. His study focuses on what he calls the “special century” from 1870 to 1970—in which living standards increased more rapidly than at any time before or after. The book is without peer in providing a statistical analysis of the uneven pace of growth and technological change, in describing the technologies that led to the remarkable progress during the special century, and in concluding with a provocative hypothesis that the future is unlikely to bring anything approaching the economic gains of the earlier period.

The message of Rise and Fall is this. For most of human history, economic progress moved at a crawl. According to the economic historian Bradford DeLong, from the first rock tools used by humanoids three million years ago, to the earliest cities ten thousand years ago, through the Middle Ages, to the beginning of the Industrial Revolution around 1800, living standards doubled (with a growth of 0.00002 percent per year). Another doubling took place over the subsequent period to 1870. Then, according to standard calculations, the world economy took off.

Gordon focuses on growth in the United States. Living standards, as measured by GDP per capita or real wages, accelerated after 1870. The growth rate looks like an inverted U. Productivity growth rose from the late nineteenth century and peaked in the 1950s, but has slowed to a crawl since 1970. In designating 1870–1970 as the special century, Gordon emphasizes that the period since 1970 has been less special. He argues that the pace of innovation has slowed since 1970 (a point that will surprise many people), and furthermore that the gains from technological improvement have been shared less broadly (a point that is widely appreciated and true).

A central aspect of Gordon’s thesis is that the conventional measures of economic growth omit some of the largest gains in living standards and therefore underestimate economic progress. A point that is little appreciated is that the standard measures of economic progress do not include gains in health and life expectancy. Nor do they include the impact of revolutionary technological improvements such as the introduction of electricity or telephones or automobiles. Most of the book is devoted to describing many of history’s crucial technological revolutions, which in Gordon’s view took place in the special century. Moreover, he argues that the innovations of today are much narrower and contribute much less to improvements in living standards than did the innovations of the special century.

Rise and Fall represents the results of a lifetime of research by one of America’s leading macroeconomists. Gordon absorbed the current thinking on economic growth as a graduate student at MIT from 1964 to 1967 (where we were classmates), studying the cutting-edge theories and empirical work of such brilliant economists as Paul Samuelson, Robert Solow, Dale Jorgenson, and Zvi Griliches. He soon settled in at Northwestern University, where his research increasingly focused on long-term growth trends and problems of measuring real income and output.

Gordon’s book is both physically and intellectually weighty. While handsomely produced, at nearly eight hundred pages it weighs as much as a small dog. I found the Kindle version more convenient. Here is a guide to the principal points.

The first chapter summarizes the major arguments succinctly and should be studied carefully. Here is the basic thesis:

The century of revolution in the United States after the Civil War was economic, not political, freeing households from an unremitting daily grind of painful manual labor, household drudgery, darkness, isolation, and early death. Only one hundred years later, daily life had changed beyond recognition. Manual outdoor jobs were replaced by work in air-conditioned environments, housework was increasingly performed by electric appliances, darkness was replaced by light, and isolation was replaced not just by travel, but also by color television images bringing the world into the living room…. The economic revolution of 1870 to 1970 was unique in human history, unrepeatable because so many of its achievements could happen only once.

The series of “only once” economic revolutions behind this short summary makes up the next fourteen chapters of the book. Most of the innovations are familiar, but Gordon tells their histories vividly. More important, in many cases, he explains quantitatively the way these economic revolutions boosted the living standards of the statistically average American. Among the most illuminating chapters are those on housing, transportation, health, and computers.

The last two chapters are about the fall in Rise and Fall. This book differs from the Spenglerian “decline of the West” genre in an important respect. As the mathematicians might say, Gordon moves up a derivative. In other words, he is not predicting that living standards in the US will decline; rather he views it as likely that the growth rate of living standards will decline from its very rapid pace in the special century.

Gordon sees two sources for his pessimistic outlook. The first is that the long list of “only once” social and economic changes cannot be repeated. A second source is what he calls “headwinds.” These are structural changes in the economy that reduce actual output below the country’s technological potential and provide another reason for slow growth in living standards in the decades ahead.

The central subject in Rise and Fall is the rapid growth of output in the 1870–1970 period, followed by a period of slower growth. We must clarify that “growth” in Gordon’s view involves intensive rather than extensive expansion. Intensive growth is that of output per unit of input, also called productivity, while extensive growth refers to total output. A standard productivity measure that encompasses all inputs is called “total factor productivity” or TFP.1

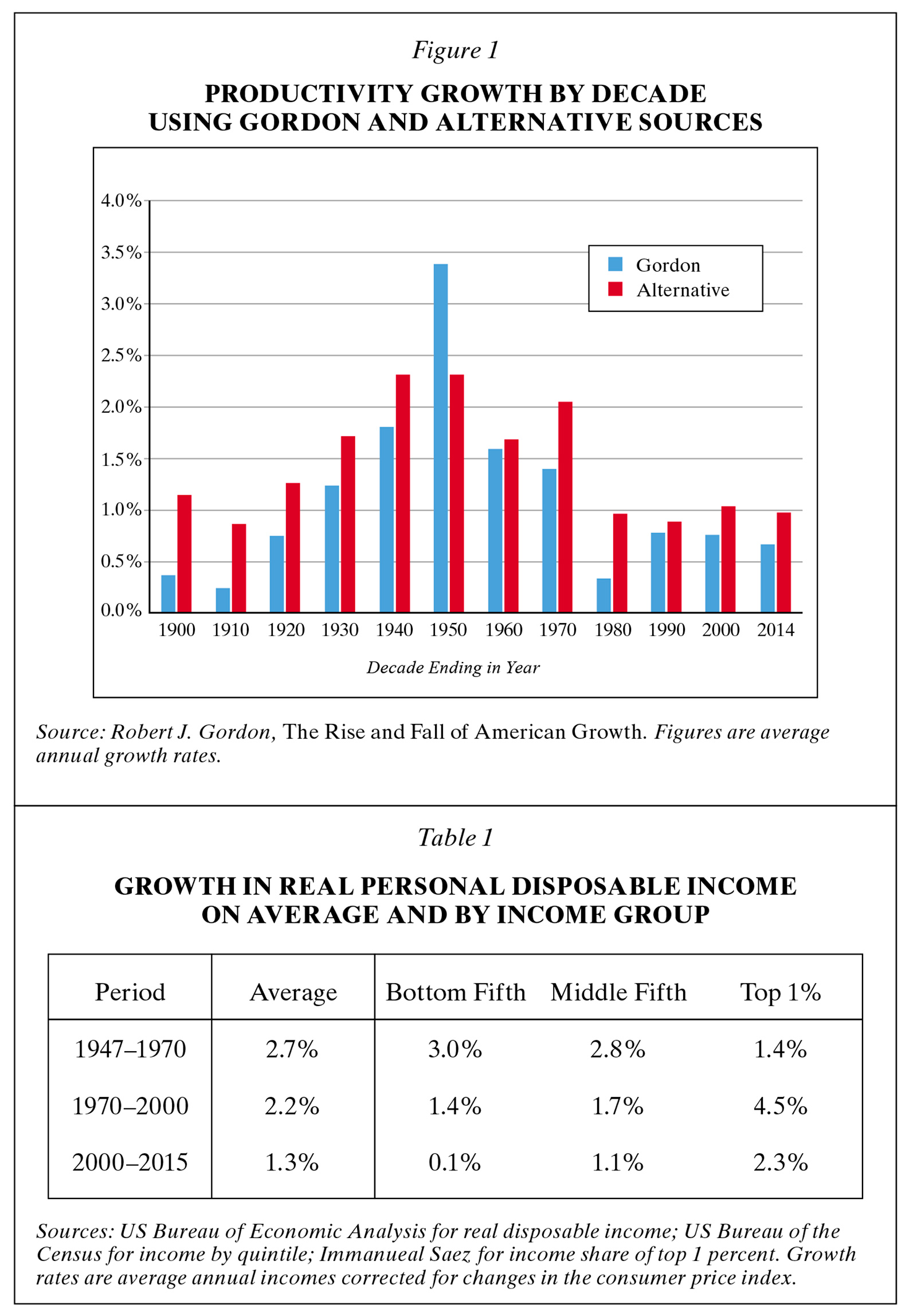

What are the underlying trends? Figure 1 on this page shows the growth in total factor productivity by decade since 1890. I show two estimates to provide an idea of how robust Gordon’s conclusions are. The one labeled “Gordon” is from his Figure 16.5. The alternative measure, which I have constructed for this review, combines other sources, with private GDP for the first half of the period covered and business output for the second half.2 (The data were provided by Gordon. A shortcoming of his book is the absence of an online appendix, and in this respect it is behind best practice.)

The main result of both measures is to confirm that there was a marked slowdown in productivity growth when we compare the earlier period (1890–1970) to the latest period (1970–2014). Both series give a slowdown of 0.6 percentage points per year in productivity growth. The alternative estimate is that the growth in productivity slowed from 1.7 percent per year in the earlier period to 1.0 percent per year in the second period.

The alternative series shows a smoother increase from the 1890–1920 period to the 1920–1970 period, and then a sharp drop after 1970. Gordon makes much of the robust productivity growth during the Great Depression and World War II, but this is not apparent in the alternative series.

Productivity growth slowed sharply after 1970, with little variability from decade to decade. The slowdown has been puzzling scholars for four decades. My own view is that it is a decline from one thousand cuts. Important ones are rising energy prices, growing regulatory burdens, a structural shift from high- to low-productivity growth sectors (such as from manufacturing to services), as well as the source that Gordon emphasizes, the decline of fundamentally important inventions.

So Gordon’s basic hypothesis looks rock solid: there has been a substantial slowdown in productivity growth since the end of the special century in 1970.

It is commonplace to complain that gross domestic product does a poor job of representing true economic welfare because it omits harmful elements such as pollutionn.3 This is true. However, most readers will be surprised to learn that the major shortcoming of conventional measures is that they underestimategrowth. Moreover, according to Gordon, the understatement was arguably much larger in the special century than before or after.

Why do conventional measures understate actual improvements in living standards? Gordon gives two principal reasons. First, the growth of real income is systematically understated because of flawed price indexes. The price indexes used to convert current dollars of output into inflation-corrected or “real” output overestimate price increases and consequently understate real output growth. Second, GDP omits many aspects of economic activity that are not captured in market transactions. The common omissions are environmental degradation, leisure time, nonmarket work, and improvements in health.

We can begin with the price-index problem. For this, I take an example familiar to most people, lighting. If you were to examine the US economic accounts, you would not find a component that measures the price of lighting or the real output of lighting. Instead, you would find elements such as the price of fuel (whale oil or electricity) and the price of lighting devices (oil lamps or lightbulbs). For each of these prices, we today have carefully designed techniques for collecting prices and spending. So, you might think, by combining correctly the prices of the lighting devices and the fuels (the input prices), we might accurately track the price of producing a certain amount of light (the output price).

Or so we thought until the actual estimates were made. It turns out for lighting that the output price fell much more sharply than the input prices. We can take the example of standard incandescent lightbulbs and LEDbulbs to illustrate. Assume that we need 800 lumens to light a space (a candle produces about thirteen lumens). Suppose that we light the space for 50,000 hours. This would require about 50 incandescent bulbs and 60 watts x 50,000 hours or 3,000 kilowatt-hours (kwh) of electricity. At the current US average electricity price of ten cents per kwh, the cost of incandescent lighting over the period would be about $350 ($50 for the bulbs and $300 for the electricity). Now assume that a new technology, LED bulbs, becomes available. You can get the same illumination with one $5 six-watt LED bulb lasting 50,000 hours. When you calculate the life-cycle costs, the 800 lumens x 50,000 hours cost only $35 ($5 for the bulb + $30 for the electricity).

So the price of lighting declined by 90 percent. And—the critical point for Gordon’s story—with the introduction of LED bulbs, every $100 of expenditures on lighting produced ten times the real output. This is not an isolated example. This same quantum jump came with each improvement in lighting technologies: from oil lamps, to kerosene lamps, to incandescent, to compact fluorescent, to LED lighting. A more detailed look at the history of lighting indicates indeed that conventional measures have understated the growth in the output of lighting by a huge margin.

How do conventional measures of prices or real output treat this major change in prices and real output? They simply ignore it. More precisely, the LED bulb is “linked” to price and output indexes when it is introduced. This means that the amount or efficiency of lighting per dollar is assumed to be unchanged.

Gordon emphasizes that this tiny but revealing story about lighting is told time and again during the special century. The major inventions that revolutionized American living standards were seldom captured in the standard indexes. Examples include running water, toilets, telephones, air travel, phonographs, television, air conditioning, central heating, antibiotics, automobiles, financial instruments, and better working conditions. These tectonic shifts in technology and living standards would generally go unrecorded in “real GDP” growth and in the growth of “real wages.”

The second source of mismeasurement concerns activities that are outside the purview of standard output measures. On close examination, many of these have little effect on the growth of real output when included. For example, if you included a correction for carbon dioxide emissions, it would reduce the level of output, but such a correction would not reduce real output growth at all over the last decade.

However, one specific measurement of error makes an enormous difference—the omission of improvements in health status. Gordon has a fascinating chapter on the sharp “only once” improvements in health and life expectancy. While some of his views on the sources of improvements in health are not persuasive, his final conclusion on the importance for living standards seems justified:

A consistent theme of this book is that the major inventions and their subsequent complementary innovations increased the quality of life far more than their contributions to market-produced GDP…. But no improvement matches the welfare benefits of the decline in mortality and increase in life expectancy….

His statement refers to a strange aspect of output measurement. Suppose we lived on average fifty years, and the average consumption of housing, food, etc. rose by 10 percent. Then our measures of living standards (real GDP or real income) would rise by 10 percent. However, assume that we had the same consumption every year, but had less illness because of antibiotics, or less pain because of anesthetics, or lived twenty years longer. Then there would be no measured gain in living standards. This seems strange, but that is the way our methods for measuring output and income are designed.

There have been several studies attempting to incorporate the benefits of improved health into measures of living standards.4 These show two important points. First, including health status increases sharply the improvement in living standards over the last century. And second, this health-status bonus was larger during the special century than before or after.

In recent years, trends in average living standards interacted with rising income inequality to produce stagnant wages in the lower and middle income groups. Table 1 shows the basic trends over recent decades. The first row shows the results of the last part of the special century. The last two rows show the period of slower growth.

The column labeled “average” shows the growth in per capita, inflation-corrected, post-tax income. This shows an income slowdown that parallels the productivity slowdown, with a decline of 1.4 percentage points from the first to the third subperiod. The slowdown in the growth of real income was largely due to the slowdown in productivity growth from the special century to the more recent period.

The last three columns show how the growth was divided between the bottom fifth, the middle fifth, and the top 1 percent of the income distribution. The first subperiod was one of shared prosperity; indeed, the bottom groups fared slightly better than the top. However, in the most recent years, particularly since 2000, the decline in average income growth was further exacerbated for the lowest income groups by a declining share of the total. So, for the bottom fifth, the growth in real income declined from 3 percent at the end of the special century to essentially zero in the last fifteen years. Of this catastrophic decline, about half was due to the slower overall growth, while half was due to rising inequality. Gordon has an extensive review of the sources of rising inequality, but his emphasis on the role of declining productivity growth is an important and durable part of the story of stagnant incomes.

The last chapter of the book suggests that the US faces major “headwinds” that will continue to drag down living standards relative to underlying productivity growth. In Gordon’s account, these headwinds are rising inequality, poor-quality education, the aging population, and rising government debt. Gordon forecasts that average growth in real income per person over the next quarter-century will be 0.7 percent per year—even lower than the 1.3 percent per year in the 2000–2015 period. If inequality continues to grow, this might lead to declining incomes of the bottom part of the distribution—and therefore to true Spenglerian decline. I emphasize that these forecasts are highly speculative and contingent on many economic, fiscal, and demographic forces.

What of the future of economic growth? Here Gordon is a leading proponent of the view emphasizing the likelihood of “secular stagnation.” There are actually two variants of the stagnation. The first, emphasized by Lawrence Summers, is “demand-side”: a global savings glut along with low inflation is leading to weak aggregate demand in the high-income regions. This syndrome is consistent with zero or negative interest rates in Europe and Japan.

Gordon’s view of stagnation is “supply-side”—referring to a slackening in the growth of productivity rather than persistent weakness caused by the business cycle and high unemployment. His pessimism does not involve the neo-Malthusianism of groups like the Club of Rome, which foretold resource exhaustion, or concerns of those like Nicholas Stern, who sees future climate-driven catastrophes. Rather, Gordon’s concept of stagnation comes from his view about the slow future pace of technological change. He recognizes the perils of forecasting technological futures. But in the end he sees the slow growth of decades since 1970 shown in Figure 1—not those of the special century—as the norm for the years to come. He does not argue that returning to rapid growth is impossible. Instead, he thinks that we have exhausted the major society-changing “only once” inventions, and he sees no prospect that we will find a similar set of inventions of such breadth and depth in the near future.

In discussing the future, Gordon dissects the arguments of the technological optimists who see a growing part in the economy for robots and artificial intelligence. An extreme pole of technological futurism is a theory called “the Singularity.” As computer scientists look into their crystal ball, they foresee artificial intelligence moving toward superintelligence, which denotes intellect that is much smarter than the best human brains in practically every field, including not just games like Go but also scientific creativity, general wisdom, and social skills. At the point where computers have achieved superintelligence, we have reached the Singularity, where humans become economically superfluous. Superintelligent computers are the last human invention, as imagined by the mathematician Irving Good:

Let an ultraintelligent machine be defined as a machine that can far surpass all the intellectual activities of any man however clever. Since the design of machines is one of these intellectual activities, an ultraintelligent machine could design even better machines; there would then unquestionably be an “intelligence explosion,” and the intelligence of man would be left far behind. Thus the first ultraintelligent machine is the last invention that man need ever make.

Gordon has no sympathy for these futuristic views. Moreover, the economic data (such as those shown in the figure and table) show no trace of a coming Singularity. If anything, growth has slowed even more since the financial crisis of 2008. But as we observe that games like chess or Go are won by a computer, it seems prudent to keep an eye on the evolution of superintelligence.

To summarize, Rise and Fall is a magnificent book on American economic history of the last century and a half. This review can touch only the major themes and has necessarily skimmed over many of the fascinating discussions of individual sectors and historical episodes. If you want to understand our history and the economic dilemmas faced by the nation today, you can spend many a fruitful hour reading Gordon’s landmark study.

Notes:- 1Productivity comes in several varieties. The simplest to measure is labor productivity, or output per hour worked. However, this does not account for improvements in education, or for changes in the access of the average worker to a larger stock of more productive capital. Total factor productivity (TFP) is a more complicated concept to measure than labor productivity because it involves measuring the contribution of capital and education, as well as determining how to weigh the different inputs, but today these are standard procedures.

A final detail is whether productivity relates to business output, to private output, or to total GDP (the latter also includes government output). Accurate measures are usually confined to business output because government output in such areas as education and military forces is difficult to measure and therefore these areas customarily are measured as inputs (teachers) rather than outputs (learning). Gordon generally uses the more comprehensive GDP because it is available for longer periods. It must be reemphasized that all productivity figures refer to measured output and omit the unmeasured contributions of important new and improved products discussed in Gordon’s main text. ↩ - 2The alternative is a splicing of the following sources: data for the early part is total factor productivity for the private economy (private GDP), 1890–1950, from Historical Statistics of the United States, Millennial Edition(Cambridge University Press, Vol. 3, Series Cg270, Cg278). The data are based on an early study by John Kendrick in Productivity Trends in the United States (Princeton University Press, 1967). These data are used for the TFP growth rates for 1890–1900 to 1940–1950. For the period 1948–2014, I use total factor productivity for the US private business sector from the US Bureau of Labor Statistics. These are available at www.bls.gov/mfp/#tables, “Historical multifactor productivity measures (SIC 1948–1987 linked to NAICS 1987–2014).” These data are used for the TFP growth rates for 1950–1960 to 2000–2014. Note that for the two periods of overlap (1950–1960 and 1960–1970), the early (Kendrick) series and the BLS series are virtually identical. From 1948 to 1970, the private GDP TFP growth rate averaged 2.13 percent per year while the BLS series averaged 2.03 percent per year. ↩

- 3

Economic statisticians have developed techniques for incorporating external effects like pollution into the measurement of national output. The method is straightforward. You would begin with a measure of the physical emissions, such as annual carbon dioxide (CO2) emissions or sulfur dioxide emissions. These would be parallel to the production of new houses, currently included in the accounts. You then multiply the quantity by a “shadow price,” which would measure the social cost of the emissions. Again, the parallel here would be multiplying the quantity of new houses by the price of the houses. Since the emissions price is a damage, or negative price, the price times quantity of emissions would be subtracted from total output.

As an example, total CO2 emissions for the United States in 2015 were 5,270 million tons. The US government estimates that the social cost of emissions is $37 per ton (all in 2009 dollars). So the total subtraction is $37 x 5,270 = $195 billion. This would be a debit from the $16,200 billion of total output in that year, or slightly more than 1 percent of output. (These data are from the Bureau of Economic Analysis and the Energy Information Administration.)

Note, however, that CO2 emissions declined over the decade from 2005 to 2015, from 5,993 billion to 5,270 billion tons per year. So the subtraction from GDP to correct for CO2 emissions was smaller in 2015 than in 2005. Growth of corrected GDP was therefore a tiny bit higher after correcting for CO2 emissions than before the correction. To be precise, after correction, the real growth rates over the 2005–2015 period would be 1.394 percent per year using the corrected figures instead of 1.385 per year using the official figures.So correcting for CO2 emissions would lower the estimate of output, but would raise by a tiny amount the estimate of growth. ↩ - 4Studies on the impact of adding health to the national economic accounts include an early example from William Nordhaus, “The Health of Nations,” in Measuring the Gains from Medical Research: An Economic Approach, edited by Kevin Murphy and Robert Topel (University of Chicago Press, 2010). ↩

Nenhum comentário:

Postar um comentário